5 Simple Techniques For Simply Solar Illinois

5 Simple Techniques For Simply Solar Illinois

Blog Article

Not known Factual Statements About Simply Solar Illinois

Table of ContentsSome Known Details About Simply Solar Illinois Rumored Buzz on Simply Solar IllinoisNot known Facts About Simply Solar IllinoisSimply Solar Illinois for BeginnersSimply Solar Illinois for Beginners

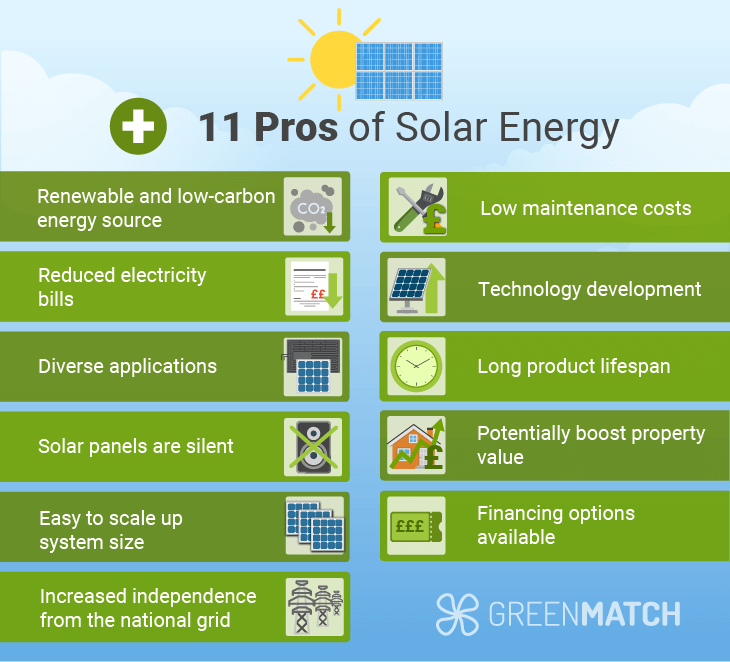

Our group companions with local communities throughout the Northeast and past to supply tidy, cost effective and trustworthy power to foster healthy areas and keep the lights on. A solar or storage space project delivers a number of benefits to the community it offers. As innovation advances and the expense of solar and storage decrease, the economic advantages of going solar remain to increase.Support for pollinator-friendly habitat Environment reconstruction on contaminated sites like brownfields and land fills Much needed color for animals like sheep and fowl "Land banking" for future agricultural use and dirt quality renovations As a result of environment change, extreme weather is ending up being more frequent and disruptive. As an outcome, house owners, organizations, communities, and utilities are all becoming extra and much more interested in protecting power supply services that offer resiliency and power safety.

Ecological sustainability is an additional vital vehicle driver for services buying solar power. Numerous firms have durable sustainability goals that include minimizing greenhouse gas emissions and utilizing less sources to aid decrease their influence on the natural surroundings. There is a growing necessity to resolve environment modification and the pressure from consumers, is arriving levels of companies.

A Biased View of Simply Solar Illinois

As we come close to 2025, the integration of photovoltaic panels in industrial tasks is no longer simply an alternative but a tactical requirement. This blogpost explores exactly how solar power jobs and the diverse advantages it gives business buildings. Solar panels have been made use of on residential structures for many years, but it's only lately that they're becoming extra typical in commercial building and construction.

It can power lighting, heating, cooling and water heating in business buildings. The panels can be installed on roofs, car parking whole lots and side backyards. In this post we review exactly how photovoltaic panels work and the advantages of using solar power in business structures. Electricity expenses in the united state are boosting, making it a lot more costly for services to run and much more tough to plan in advance.

The United State Power Information Administration anticipates electric generation from solar to be the leading resource of growth in the united state power market through the end of 2025, with 79 GW of brand-new solar ability predicted ahead online over the next two years. In the EIA's Short-Term Energy Overview, the firm claimed it anticipates eco-friendly power's general share of electrical power generation to rise to 26% by the end of 2025

Some Known Incorrect Statements About Simply Solar Illinois

The photovoltaic solar cell takes in solar radiation. The cords feed this DC electrical energy right into the solar inverter and transform it to alternating power (AC).

There are several methods to keep solar energy: When solar power is fed into an electrochemical battery, the chain reaction on the battery elements keeps the solar power. In a reverse reaction, the current leaves from the battery use this link storage for consumption. Thermal storage utilizes tools such as liquified salt or water to retain and take in the heat from the sun.

Solar panels considerably lower power expenses. While the first investment can be high, overtime the price of setting up solar panels is recouped by the money saved on electricity bills.

Simply Solar Illinois Fundamentals Explained

By installing photovoltaic panels, a brand name reveals that it cares concerning the setting and is making an initiative to minimize its carbon footprint. Structures that count entirely on electric grids are prone to power blackouts that occur during poor weather condition or electric system breakdowns. Solar panels installed with battery systems enable industrial buildings to continue to operate during power interruptions.

The Only Guide to Simply Solar Illinois

Solar energy is just one of the cleanest forms of energy. With long-lasting service warranties and a production life of approximately 40-50 years, solar financial investments add substantially to ecological sustainability. This change in the direction moved here of cleaner energy resources can bring about broader financial benefits, including minimized environment change and ecological deterioration expenses. In 2024, house owners can benefit from federal solar tax obligation rewards, permitting them to counter virtually one-third of the purchase cost of a planetary system through a 30% tax credit.

Report this page